In the SaaS industry, time and money are short supply for start-ups and small businesses alike. Getting your business off the ground and producing income is a never-ending race. Using a SaaS-friendly Subscription payments service is a great approach to cut expenses and speed up time to market. For SaaS-based businesses, subscription-based billing systems are specifically created. If you want to benefit from the best of both worlds, you can’t go wrong with either of these options.

What’s a subscription payments service?

Recurring payments, often known as subscription payments, are made regularly. Subscription services often charge monthly or yearly until customers cancel or withdraw their authorisation.

How does subscription-based service work?

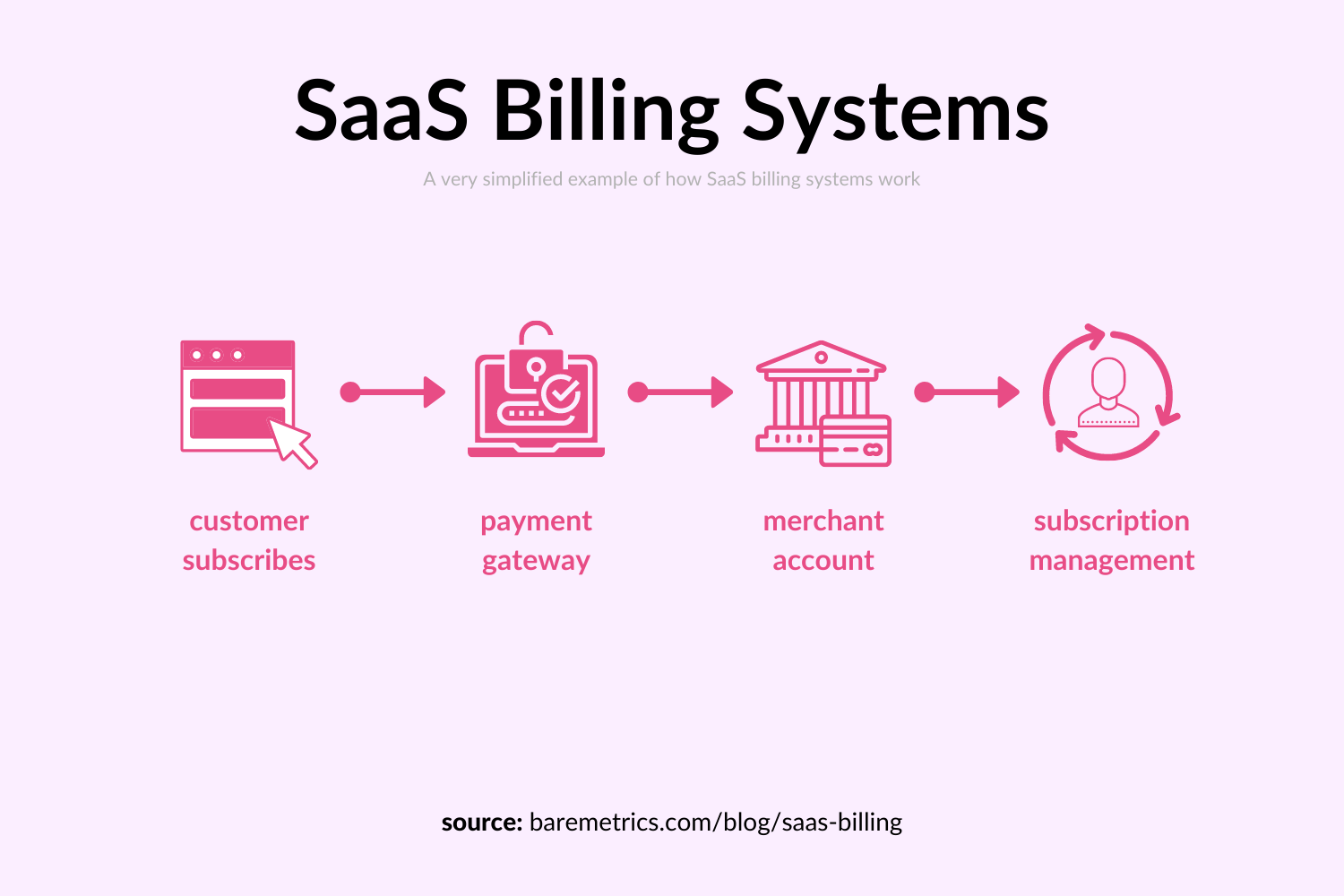

Although the payment procedure is short and straightforward from the customer’s perspective, there are several processes involved:

- Consumers can select the payment schedule and method that works best for them.

- The merchant obtains the order information and manages subscription billing.

- From there, the Subscription payments service takes care of the payment. The credit card information is stored securely, and the payment request is sent to the payment gateway, card association, processor and issuer.

- Regular invoices and statements are sent to the client.

Benefits of using a recurring billing system that is SaaS-friendly

Time-to-Market Is faster: You take a step further constructing a long-term business every time you speed up the process of entering the market and establishing an income stream. Using a ready-to-use system allows you to save a significant amount of time

Savings on the initial investment: Most start-ups don’t have the luxury of taking money for granted. If you don’t have the time or resources to construct your billing system, a SaaS-friendly option is a far more cost-effective option than building your own.

Good documentation and a versatile API: When it comes to building a SaaS platform, it’s important to have an API that’s flexible, well-documented, and powerful. This eliminates the need for any guesswork and helps you create a seamless experience for your users.

Increased protection: Any online transaction must prioritise safety as a high priority. Security is a primary priority for a SaaS-friendly billing system; also PCI compliant. A security breach and the ensuing public relations disaster are the last things a newly appointed CEO needs.

Flexible choice: An open-source billing system will allow you to shop around for the best rates and avoid gateway lock-in by integrating with a wide range of payment gateways. It can save you hundreds in transaction costs, which can compensate for the expense of the billing system itself.

Options for flexible billing: A SaaS-friendly billing system is designed to cater to the invoicing requirements of SaaS service providers. They let you customise how, why, and when you charge clients with various billing cycles and combinations.

Promotions and trial periods: Many SaaS providers rely heavily on freemium and trial periods for their marketing efforts. You can incorporate plan upgrades and downgrades, trial periods, discount offers, and much more with complete freedom when using a SaaS-friendly billing system.

Automation features: You can automate and expedite the sales process with a well-designed billing system. Using a SaaS-friendly Subscription payments service will save you a lot of time and improve your customer’s experience by automatically retrying rejected payments.

Using a billing system that is suitable for SaaS has numerous advantages. Finally, all of this boils down to a simple fact: Your start-up company makes more money quicker. So if you haven’t already, it’s a good idea to check into a SaaS-friendly solution.

Author Bio:

Alison Lurie is a farmer of words in the field of creativity. She is an experienced independent content writer with a demonstrated history of working in the writing and editing industry. She is a multi-niche content chef who loves cooking new things.